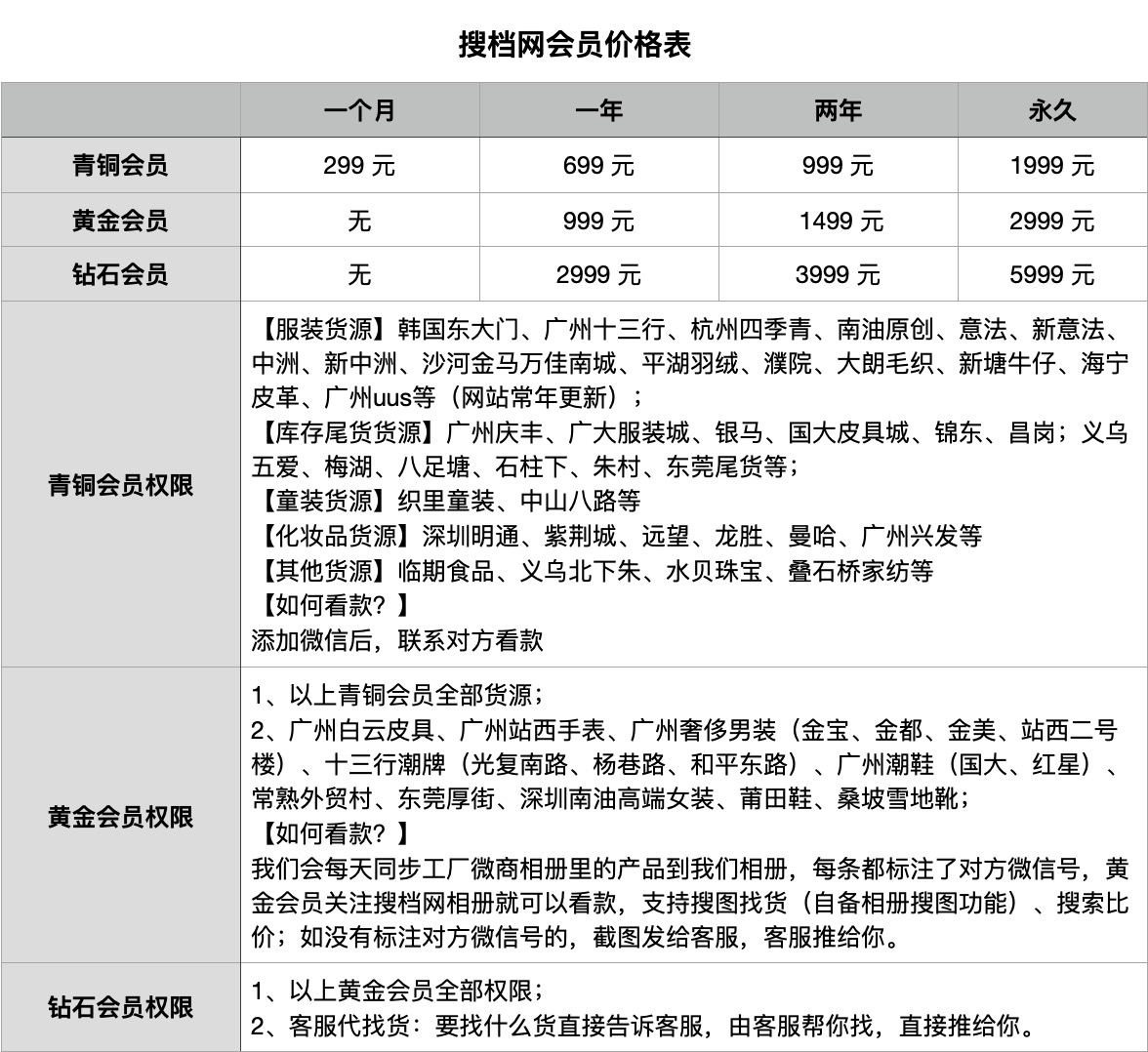

For China′s wholesale market information, visit Soudangkou.com at cdn.soudangkou.com . Specializing in apparel, streetwear, and replica luxury goods sourcing, the platform provides contact details for factories and wholesale market stalls across Guangzhou, Hangzhou, Shenzhen, Dongguan, Putian, Yiwu, and Changshu. Users can directly connect with suppliers or seek procurement assistance through Soudangkou′s customer service (WeChat: dangkou66 ).

Importing goods from China to India presents a lucrative avenue for businesses in search of affordable materials and top-notch products. It serves as an advantageous strategy for companies looking to optimize their revenue streams, as the import process between these two economic giants plays a pivotal role in fulfilling the supply and demand requirements of Indian enterprises.

Notwithstanding the potential benefits, importing goods from China to India necessitates careful planning and thoughtful deliberation due to the multiple intricate steps involved. Each stage counts as a critical component for a successful import venture, from qualification preparation and finding reliable suppliers to navigating through customs and understanding tax obligations.

We will uncover a roadmap along with valuable insights to streamline your import journey in this guide. By mastering these steps, your business can harness the potential of China’s manufacturing capabilities to deliver competitive products to the Indian market.

Table of contents

hide

Step 1: Qualification Preparation Before Import From China to India

Step 2: Finding Suppliers In China

Step 3: Placing Order & Conducting Quality Inspection

Step 4: Choosing the Right Shipping Agent for China-India Logistics

Step 5: Taxes and Fees Payable at The Time of Import

Step 6: Documentation Required When Import

Payment Methods for Goods

Tips for Importing from China to India

Challenges and mitigations

Final Thoughts

Step 1: Qualification Preparation Before Import From China to India

Prior to embarking on the import procedure from China to India, it is crucial to verify that you possess the essential qualifications and registrations that are required.

1. Business Registration

Business registration establishes your legal entity and enables you to engage in commercial activities. This process entails registering your business with the appropriate government authorities in India, such as the Registrar of Companies. This process typically requires submitting relevant documents, such as the company’s memorandum of association and articles of association.

2. Tax Registration

The only way your import export company will be able to operate legally is by getting a GST registration so you can comply with Indian tax laws. In simple words, the purpose of GST number is to help you follow tax obligations, and file tax returns on applicable goods.

3. Importer-Exporter Code (IEC) Registration

Securing an Importer-Exporter Code (IEC) holds significant importance when engaging in import operations, as it serves as a distinctive identification number for businesses involved in import-export endeavors. The issuance of the IEC code is carried out by the Directorate General of Foreign Trade (DGFT) and is mandatory for customs clearance purposes. To obtain an IEC code, it is necessary to submit the requisite documents, including proof of business entity and bank information.

Step 2: Finding Suppliers In China

To begin, it’s important to conduct thorough research and leverage various sourcing channels. Trade directories, online marketplaces, and industry-specific exhibitions are excellent resources to identify potential suppliers.

However, finding suppliers in China requires more than just a quick search. It entails careful evaluation and verification of their credentials, such as their production capabilities, product quality, and business reputation. Communicating directly with suppliers through emails or phone calls is crucial to establish a solid understanding of their offerings and build trust.

Due to factors such as the geopolitical influence between China and India and the huge trade deficit, Indian customs charges high tariffs on many product categories imported from China. We have sorted out product categories with relatively high tariffs. The following categories need to be carefully considered

Step 3: Placing Order & Conducting Quality Inspection

After finding the right suppliers in China, the next important step is to effectively place your order. This involves carefully considering various factors to make sure the transaction goes smoothly and the products meet the desired quality standards.

1. Clear communication

To start things off, make sure you communicate your needs clearly to the supplier. Tell them exactly what you’re looking for in terms of product specifications, how many you need, how you want them packaged, and when you want them delivered. Keep the communication channels open and stay in touch with the supplier throughout the entire order process.

2. Quality inspection

Once you’ve placed your order, it is strongly advised to perform a thorough quality assessment before dispatching the products. Conducting quality inspections is crucial to ensure that the products meet your expectations and adhere to the agreed specifications. This crucial step helps prevent any potential issues and assures you of receiving goods of the desired quality.

3. Third-party inspection

One way to ensure quality inspections is by hiring a third-party agency specialized in your industry. These agencies are knowledgeable and experienced in following international quality standards. They have their own inspection guidelines and can assess quality at various production stages, such as before it begins, during the process, and just before shipment.

During the quality inspection, the inspector carefully examines the products to find any problems, ensure they meet the specifications, and function correctly. They may conduct tests, such as durability or performance checks, to ensure they meet the necessary standards. The inspection report they provide is valuable as it gives you important information and evidence of the product’s condition.

Step 4: Choosing the Right Shipping Agent for China-India Logistics

Shipping agents deal with logistics, and custom clearance among other things involved when you transport goods from China to India.

1. What do shipping agents do?

You can think of shipping agents as the superheroes of shipping. They take care of tasks like booking cargo, haggling with shipping companies to get the best prices, filling out paperwork, and keeping an eye on your shipments.

2. How to choose a shipping agent?

When selecting a shipping agent for your China-India logistics, you want to look for someone who has a good reputation in handling similar shipments. It’s just like choosing a reliable friend to help you move your stuff. You also want to make sure they have a strong network of trustworthy carriers and brokers.

3. The benefits of having a shipping agent

Your shipping agent will make sure that your goods are delivered on time by finding the best routes and coordinating throughout transportation efficiently. They also help with customs clearance, make sure that everything follows the rules and regulations so you never get stuck with delays or charges any fines. It’s like having someone who knows all the secret shortcuts and can speak the customs language fluently.

Step 5: Taxes and Fees Payable at The Time of Import

1. Customs Duties

The Indian government imposes customs duties on imported goods, which are calculated using the customs value of the product. The customs value is determined by considering the assessable value of the goods along with the expenses incurred for freight and insurance.

2. Import Taxes

When it comes to imported goods, additional taxes like Goods and Services Tax (GST) and Integrated Goods and Services Tax (IGST) are also applied. GST is imposed on the assessable value plus customs duty, while IGST is levied on the assessable value plus customs duty and the IGST amount itself.

3. Other Fees

In addition to customs duties and import taxes, there are other fees that may be payable at the time of import. These can include handling charges, port charges, documentation fees, and clearance charges. These fees are associated with the logistics and administrative processes involved in importing goods and vary based on factors such as the port of entry and the nature of the goods.

Step 6: Documentation Required When Import

1. Submitting the Bill of Entry and Essential Documentation for Customs Clearance

To clear customs for importing goods, you need to submit the Bill of Entry along with essential documents. This includes providing your PAN (Permanent Account Number) based on your BIN (Business Identification Number), as required by the Customs Act. The Bill of Entry contains important details about the goods, such as their nature, quantity, and value. If your goods have already gone through the EDI system, a formal Bill of Entry is not required. However, you still need to submit a shipment declaration with all the necessary information for smooth clearance of your goods.

2. Documents required for manual filing of bill of entry

When you manually file the Bill of Entry instead of using the EDI system, you need to include additional supporting documents. These documents are important for verifying the authenticity, origin, and details of the imported goods. One specific document required is the Inspection Certificate, which proves that the goods have been inspected and meet quality and safety standards.

-

Certificate of Origin (COI)

The COI confirms the origin of the imported goods, specifying the country or region where they were produced, manufactured, or obtained. This certificate is important for determining eligibility for preferential trade agreements or customs duty benefits.

-

Bill of Exchange

The Bill of Exchange is a significant financial document that outlines the agreement between the importer and exporter. It contains information about when and how much money should be paid, managing the financial aspects of importing goods.

-

Invoice & Packaging List

This document combines information from the commercial invoice and packing list. It includes important details such as the description, quantity, unit price, total value, packaging details, and weight of the goods. The Invoice cum Packaging List provides a comprehensive overview that customs officials use to cross-check against the Bill of Entry.

Upon the arrival of the imported items, customs officials meticulously compare the details provided in the Bill of Entry with the actual goods. If everything matches and there are no discrepancies, the customs officials issue a ‘pass out order,’ granting permission for the imported items to be released from customs.

Payment Methods for Goods

1. Bank Transfers

One common method of payment is bank transfers. During a bank transfer, funds are moved directly from the buyer’s bank account to the supplier’s account. Bank transfers are generally secure and provide a reliable means of payment.

2. Letters of Credit

Another option is using letters of credit (LC). In this method, a bank guarantees the payment to the supplier upon presentation of the required documents. Letters of credit provide a level of security for both parties involved in the transaction.

3. Online Payment

Online payment platforms have gained popularity in recent years. Platforms like PayPal, Alipay, and Escrow offer convenient and secure ways to make payments. They provide buyer protection and facilitate smooth transactions. However, it’s important to ensure that the chosen platform is widely accepted and reliable in both China and India.

Tips for Importing from China to India

-

Influence of Geopolitics on Import/Export Policies

Geopolitical factors can influence import/export policies between China and India. Stay updated on changes and regulations that may affect trade. Monitor trade agreements, tariffs, and politics to make informed decisions and overcome challenges.

-

Effective Communication with Chinese Suppliers

When importing fabric from China, effective communication with your suppliers is crucial for a smooth process. Think of it like building something together. For example, imagine you and a friend are baking a cake. To make sure the cake turns out just right, you need to communicate clearly about the flavours, size, and decorations you want.

Similarly, when importing fabric from China to India, openly express your needs. Clearly communicate the desired texture, colour, and quantity to your suppliers. This helps them understand your requirements accurately. Stay responsive and maintain regular contact, just like checking on the progress of the cake. Promptly reply to messages and inquiries from your suppliers. This builds trust and ensures everyone is on the same page throughout the process.

Be sure to address any concerns as soon as they arise. To put it simply, make it a point to communicate any modifications or questions to your suppliers. This helps prevent misunderstandings and keeps things running smoothly.

Challenges and mitigations

Importing goods from China to India can give way to many challenges like language barriers, cultural differences, logistics complexities, and changing import/export regulations. You can try meeting these challenges by hiring local agents or translators. Conducting thorough research on cultural forms, and partnering with experienced logistics providers, are also good ways to handle this. And most importantly, stay updated on trade policies and regulations.

By implementing these strategies, you can navigate the complexities, and ensure a smoother import process from China to India.

Final Thoughts

To import goods from China to India, you need effective communication and a good understanding of import procedures. Before diving into it, make sure that you understand the qualifications. Then, seek trustworthy suppliers, conduct quality inspections, manage logistics and handle necessary documentation. This will ensure successful imports.

It’s also important to stay informed about geopolitical influences, build strong relationships with Chinese suppliers, and explore competitive product categories. By considering these factors, you can reap the benefits of importing and contribute to their growth in the China to India import market.

![Must-See for New Store Owners! In-Depth Analysis of Nanyou Building 108’s [34 Bestselling Wholesalers]! Bestsellers, Designer Styles, and New Chinese Chic All in One Place!](https://cdn.soudangkou.com/2025/10/20251031022627852.png)